How to Prepare a Trust Accounting in California

A trust accounting is a critical tool for trustees to ensure transparency and accountability when managing trust assets. In California, trustees are required to provide trust accounting to beneficiaries in accordance with the California Probate Code. Here’s a step-by-step guide on how to prepare a trust accounting in California.

What Is a Trust Accounting?

A trust accounting is a detailed report that provides beneficiaries with an overview of the trust’s financial activities. It typically includes a record of income, expenses, distributions, and the current status of the trust’s assets.

Under California Probate Code §16062, trustees must provide an annual accounting to beneficiaries, except under certain conditions. For example, an accounting wouldn’t be required if the trust instrument explicitly waives this requirement.

Why Is Trust Accounting Important?

Trust accounting is vital for maintaining transparency and confidence between the beneficiaries and the trustee. It demonstrates that the trustee is fulfilling their fiduciary duty and managing trust assets responsibly. Failing to provide proper trust accounting can lead to disputes, legal challenges, or even removal of the trustee.

Who Is Entitled to An Accounting?

In general, a trustee must provide an accounting to all of the named trust beneficiaries, unless the trust states otherwise. Some trusts may waive the need to provide an accounting, while others may state that other parties are entitled to receive an accounting.

But in general, an heir who is not named as a beneficiary or a person who has been specifically disinherited would not be entitled to receive an accounting.

When Do I Need to Prepare a California Trust Accounting?

Trustees may wonder when they are required to prepare a trust accounting. The trustee must account at least annually unless the trust states otherwise. They must also prepare an accounting when the trust administration is closed or when a new trustee is appointed.

In addition, beneficiaries may request an update from the trustee at any time. Trustees should keep them reasonably informed of the status of the trust administration throughout the process. If a trustee does not provide timely updates, the beneficiaries may petition the court to compel a trustee to provide an accounting.

Key Elements of a Trust Accounting

A proper trust accounting should include the following:

Beginning Inventory: List all trust assets as of the starting date of the accounting period. Include detailed descriptions and values for each asset, such as bank accounts, investments, real estate, or personal property.

Receipts: Document all income received by the trust during the accounting period. Examples include rental income, interest, dividends, and proceeds from asset sales.

Disbursements: Provide a record of all expenses paid by the trust, such as property taxes, maintenance costs, legal fees, or trustee compensation.

Distributions to Beneficiaries: Include details of any distributions made to beneficiaries, specifying amounts and dates.

Assets on Hand: Show the current balance of trust assets at the end of the accounting period. This may include bank statements, investment accounts, and updated valuations of real property.

Gain or Loss: Report any gains or losses resulting from the sale or investment of trust assets.

Notes or Explanations: Add explanatory notes if necessary to clarify transactions or unusual activities.

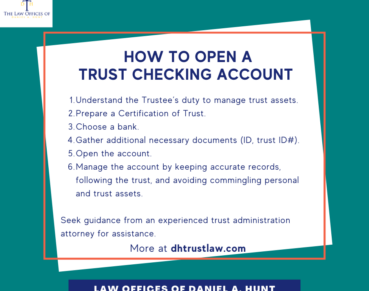

Steps to Prepare a Trust Accounting

Here are the basic steps to preparing a trust accounting:

1. Organize Financial Records

Gather all documentation related to trust assets, income, expenses, and distributions for the accounting period.

2. Use a Clear Format

California Probate Code requires that the accounting follow a clear and understandable structure. Many trustees use a spreadsheet or financial software to organize this information. You can also consult a professional fiduciary or attorney for templates or software recommendations.

3. Follow Probate Code Requirements

Ensure that the accounting complies with California Probate Code §1060-1064. These sections outline the necessary structure and details for trust accountings.

4. Seek Professional Help if Needed

Preparing a trust accounting can be complex, especially for large or diversified trusts. Trustees may benefit from asking a trust administration attorney, accountant, or professional fiduciary to assist with this task.

5. Provide the Accounting to Beneficiaries

Once completed, the trust accounting must be delivered to beneficiaries entitled to receive it. Include a copy of the accounting and, if required, a notice of the beneficiaries’ rights to object.

If you have any questions about how to prepare a trust accounting in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.